To effectively navigate the evolving landscape of online lending, understanding trace loans is crucial. This article will explore trace loans. It will define them, discuss their benefits, and explain how they work. It will also look at their impact on the financial ecosystem.

Also, read this: What is the torch on a letterman jacket for?

What are Traceloans?

Traceloans is a tech-based lending platform. It streamlines the borrowing process. They provide a clear, efficient way for consumers to get loans. Lenders gain valuable insights into borrower behavior and loan performance.

The Evolution of Lending

The lending industry has undergone significant changes over the past few decades. Fintech companies use technology to offer faster, more accessible loans. They have challenged traditional banks. Traceloans are a new wave in this evolution. They combine traditional lending with modern technology.

Benefits of Traceloans

1. Transparency

Traceloans give borrowers clear info on loan terms, rates, and repayments. This transparency helps borrowers make informed decisions.

Also, read this: imgSED: The Ultimate Solution for Streamlined Image Management

2. Speed

The application process for traceloans is typically faster than traditional loans. Automated systems can evaluate applications and disburse funds in a matter of hours or even minutes.

3. Accessibility

Traceloans are often more accessible to individuals with less-than-perfect credit histories. They use alternative data to assess creditworthiness. This widens the pool of eligible borrowers.

4. Flexibility

Many traceloan providers offer flexible repayment options. They tailor them to borrowers’ finances. This helps borrowers manage their debts.

How Traceloans Work

1. Application Process

It starts with an online application. Borrowers must provide personal and financial info. This information is then assessed using algorithms that evaluate credit risk.

2. Approval and Funding

Once the application is submitted, the system quickly analyzes the data. If approved, funds are typically deposited into the borrower’s account within a short timeframe.

3. Repayment

Borrowers repay their loans via scheduled payments. These can be adjusted based on their finances.

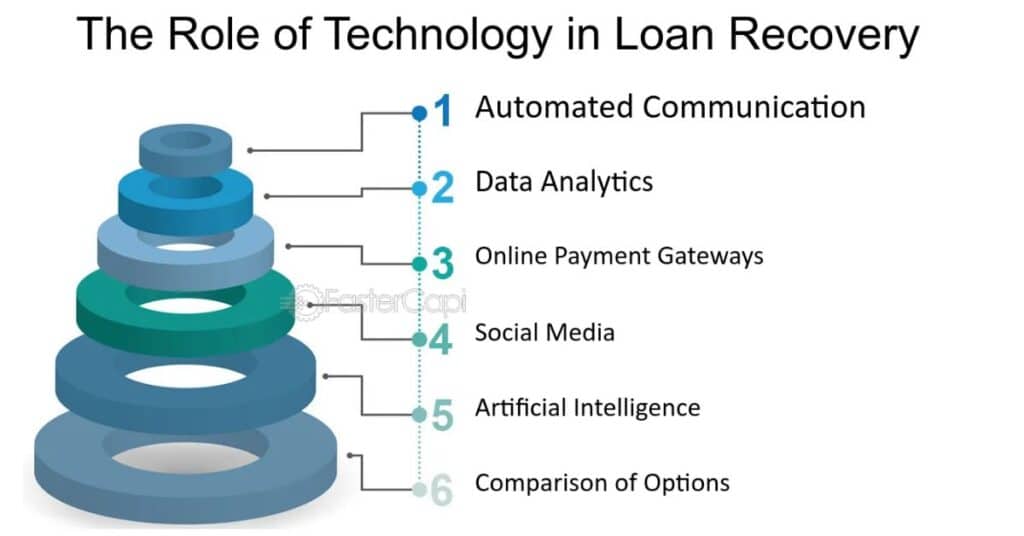

The Role of Technology in Trace Loans

Technology plays a pivotal role in the functionality of trace loans. Advanced algorithms and machine learning models analyze vast data. They assess risk and determine loan eligibility efficiently.

The Impact on Borrowers

Traceloans can help borrowers. They provide funds that are not available through traditional means. This access can help individuals manage emergencies, consolidate debt, or finance significant purchases.

The Impact on Lenders

For lenders, trace loans offer an opportunity to tap into new markets and diversify their portfolios. By using tech to assess risk better, lenders can cut defaults and boost returns.

Regulatory Considerations

As with any financial product, trace loans are subject to regulatory scrutiny. Providers must comply with local lending laws to protect consumers.

Challenges Faced by Traceloan Providers

Traceloan providers have advantages but face challenges. They compete with traditional banks and other fintech companies. Additionally, maintaining data security and privacy is paramount in building trust with consumers.

Future Trends in Traceloans

1. Increased Personalization

Future traceloan platforms will likely offer more personalized loans. They will base them on borrowers’ profiles and behaviors.

2. Enhanced Data Analytics

As technology evolves, so will the ability to analyze borrower data. This will improve risk assessment and loan performance tracking.

3. Integration with Other Financial Services

Traceloan platforms may integrate more with other financial services. These include budgeting tools and investment platforms. This would create a holistic approach to personal finance management.

Conclusion

Traceloans represent a significant shift in how individuals access credit in today’s digital age. Their focus on transparency, speed, and access makes them a good choice for borrowers. They also offer lenders new ways to engage with new markets. As technology evolves, so will traceloans’ potential to reshape lending. Understanding traceloans helps borrowers and lenders make smart choices in a complex market.

Fashioneleganto, curated by fashion enthusiast Brook, is your go-to destination for chic and elegant styles. Discover the latest trends, timeless classics, and expert styling tips for every occasion.